Basic Introduction

⇒ Statutory Overreaching is the second device through which the law intended to reduce the influence of the doctrine of notice (Land Charges Registration is the other).

⇒ This doctrine applies equally equally to registered and unregistered estates in land.

⇒ As noted previously, beneficial interests under trust cannot be registered on the land charges register. Thus, they are dealt with by the doctrine of statutory overreaching. In other words, a beneficial interest under trust is capable of binding 3rd parties through overreaching.

Basic introduction to trusts

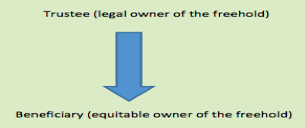

⇒ The following diagram is an example of the simplest trust: there is one trustee (someone who owns the legal interest in the land) and one beneficiary (someone who owns the equitable interest in the land).

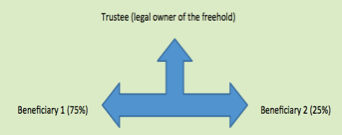

⇒ A more complicated trust could be where there is more than one beneficiary (i.e. there are 2 or more people who share the equitable interest in the land).

⇒ The beneficial interest under trust (i.e. the equitable interest held by the beneficiaries in the above examples) is an equitable right in rem i.e. a right recognised by equity capable of binding third parties.

⇒ Beneficial interests under trust are therefore capable of binding a transferee/purchaser of the legal freehold.

The problem

⇒ Were the beneficial interest under trust actually to bind a purchaser of the legal freehold, the purchaser would himself become trustee of the freehold and obliged to hold it entirely for the beneficiary’s benefit.

⇒ While this would be a satisfactory outcome for the right-holder (the beneficiary) this would be most unsatisfactory for the purchaser as he would get nothing of value (i.e. he/she could not enjoy the house bought, as it would have to be held entirely for the beneficiary's benefit).

⇒ So the law tries to control the cirucmstances in which this right in rem, which is capable of binding third parties, actually does bind because the consequences of it actually binding are so substantial and so damaging. This is why a beneficial interest under trust cannot be registered as a land charge.

⇒ But the doctrine of overreaching ensures the beneficiaries retains rights even after the land is sold.

The Art of Getting a First in Law - ONLY £4.99

FOOL-PROOF methods of obtaining top grades

SECRETS your professors won't tell you and your peers don't know

INSIDER TIPS and tricks so you can spend less time studying and land the perfect job

We work really hard to provide you with incredible law notes for free...

The proceeds of this eBook helps us to run the site and keep the service FREE!

Overreaching explained

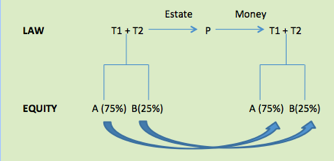

⇒ Overreaching operates to detach beneficial rights under trust from land on transfer, so that a transferee cannot be affected by them. In other words, the beneficial rights under the trust detatch from the land, meaning the purchaser cannot be affected by the (so the purchaser takes free from the beneficial interest under trust).

⇒ The rights then reattach themselves to the replacement property that the trustees receive from the transferee (i.e. the money); this property becomes the trust property in place of the land.

Stautory preconditions of overreaching

⇒ The equitable interest must be capable of overreaching (section 2(1)(i) Law of Property Act 1925).

⇒ The Law of Property Act 1925, section 27, says that in order for an equitable interest under a trust to be overreached the capital money arising from the sale must be paid to 2 trustees.

The residual category of equitable rights in rem

⇒ Some equitable rights are neither capable of registration as land charges (i.e. not listed in the Land Charges Act 1972, section 2) nor overreachable.

⇒ These rights are governed by the historical doctrine of notice i.e. bind all transferees except equity's darling e.g. Eqitable co-ownership interests behind a trust of land and equitable interests under a Settled land Act Settlement are both governed by the doctrine of notice. Also pre-1926 easements and covenants and pre-1926 class B + C land charges are governed by notice.

- See the topic notes on notice.

⇒ See, for example, the case of Kingsnorth Finance v Tizard [1986].

Law Application Masterclass - ONLY £9.99

Learn how to effortlessly land vacation schemes, training contracts, and pupillages by making your law applications awesome. This eBook is constructed by lawyers and recruiters from the world's leading law firms and barristers' chambers.

✅ 60+ page eBook

✅ Research Methods, Success Secrets, Tips, Tricks, and more!

✅ Help keep Digestible Notes FREE